Fx Forward Contract Template

Fx Forward Contract

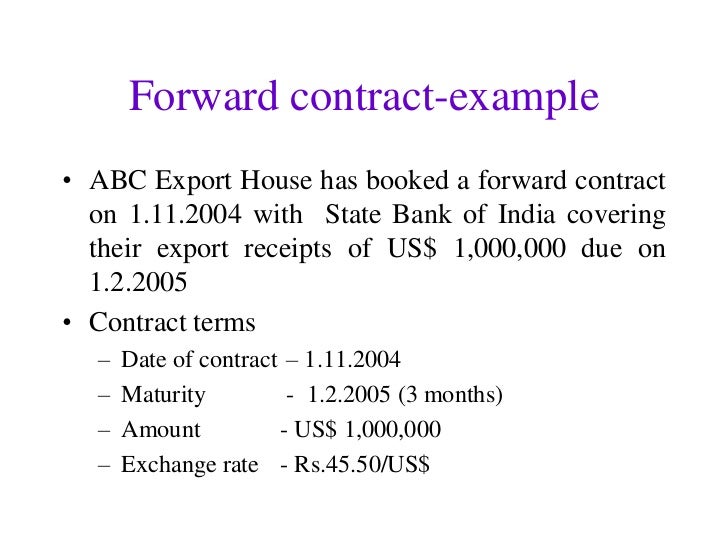

Understanding FX Forwards A Guide for Microfinance. Forwards Use: Forward exchange contracts are used by market participants to lock in an exchange rate on. Forward Foreign Exchange Contracts). Before entering into a foreign exchange contract you sho uld give consideration to your objectives, financial situation.

. In finance, a forward contract or simply a forward is a non-standardized contract between two parties to buy or to sell an asset at a specified future time at a price agreed upon today, making it a type of. The party agreeing to buy the underlying asset in the future assumes a, and the party agreeing to sell the asset in the future assumes a. The price agreed upon is called the, which is equal to the at the time the contract is entered into. The price of the underlying instrument, in whatever form, is paid before control of the instrument changes. This is one of the many forms of buy/sell orders where the time and date of trade is not the same as the where the themselves are exchanged.

Forwards, like other derivative securities, can be used to risk (typically currency or exchange rate risk), as a means of, or to allow a party to take advantage of a quality of the underlying instrument which is time-sensitive. A closely related contract is a; they. Forward contracts are very similar to futures contracts, except they are not exchange-traded, or defined on standardized assets.

Forwards also typically have no interim partial settlements or 'true-ups' in margin requirements like futures – such that the parties do not exchange additional property securing the party at gain and the entire unrealized gain or loss builds up while the contract is open. However, being traded, forward contracts specification can be customized and may include mark-to-market and daily margin calls. Hence, a forward contract arrangement might call for the loss party to pledge collateral or additional collateral to better secure the party at gain. In other words, the terms of the forward contract will determine the collateral calls based upon certain 'trigger' events relevant to a particular counterparty such as among other things, credit ratings, value of assets under management or redemptions over a specific time frame, e.g., quarterly, annually, etc. How a forward contract works Suppose that Bob wants to buy a house a year from now. At the same time, suppose that Andy currently owns a $100,000 house that he wishes to sell a year from now. Both parties could enter into a forward contract with each other.

Suppose that they both agree on the sale price in one year's time of $104,000 (more below on why the sale price should be this amount). Andy and Bob have entered into a forward contract. Bob, because he is buying the underlying, is said to have entered a long forward contract. Conversely, Andy will have the short forward contract. At the end of one year, suppose that the current market valuation of Andy's house is $110,000.

Fx Forward Contract Rates

Then, because Andy is obliged to sell to Bob for only $104,000, Bob will make a profit of $6,000. To see why this is so, one needs only to recognize that Bob can buy from Andy for $104,000 and immediately sell to the market for $110,000. Bob has made the difference in profit. In contrast, Andy has made a potential loss of $6,000, and an actual profit of $4,000. The similar situation works among currency forwards, in which one party opens a forward contract to buy or sell a currency (ex. A contract to buy Canadian dollars) to expire/settle at a future date, as they do not wish to be exposed to exchange rate/currency risk over a period of time.

As the exchange rate between U.S. Dollars and Canadian dollars fluctuates between the trade date and the earlier of the date at which the contract is closed or the expiration date, one party gains and the counterparty loses as one currency strengthens against the other. Cosma nonstop torrent. Sometimes, the buy forward is opened because the investor will actually need Canadian dollars at a future date such as to pay a debt owed that is denominated in Canadian dollars. Other times, the party opening a forward does so, not because they need Canadian dollars nor because they are hedging currency risk, but because they are speculating on the currency, expecting the exchange rate to move favorably to generate a gain on closing the contract.

In a currency forward, the of currencies are specified (ex: a contract to buy $100 million Canadian dollars equivalent to, say $75.2 million USD at the current rate—these two amounts are called the notional amount(s)). While the notional amount or reference amount may be a large number, the cost or margin requirement to command or open such a contract is considerably less than that amount, which refers to the created, which is typical in contracts. Example of how forward prices should be agreed upon Continuing on the example above, suppose now that the initial price of Andy's house is $100,000 and that Bob enters into a forward contract to buy the house one year from today. But since Andy knows that he can immediately sell for $100,000 and place the proceeds in the bank, he wants to be compensated for the delayed sale. Suppose that the risk free rate of return R (the bank rate) for one year is 4%. Then the money in the bank would grow to $104,000, risk free. So Andy would want at least $104,000 one year from now for the contract to be worthwhile for him – the opportunity cost will be covered.

Spot–forward parity. ^ John C Hull, Options, Futures and Other Derivatives (6th edition), Prentice Hall: New Jersey, USA, 2006, 3., Federal Reserve Bank of Chicago., NBER. J.M. Keynes, A Treatise on Money, London: Macmillan, 1930. J.R.

Fx Forward Contract Valuation

Hicks, Value and Capital, Oxford: Clarendon Press, 1939., Investopedia References. John C. Hull, (2000), Options, Futures and other Derivatives, Prentice-Hall. Keith Redhead, (31 October 1996), Financial Derivatives: An Introduction to Futures, Forwards, Options and Swaps, Prentice-Hall. Abraham Lioui & Patrice Poncet, (March 30, 2005), Dynamic Asset Allocation with Forwards and Futures, Springer.

Further reading. Allaz, B. And Vila, J.-L., Cournot competition, futures markets and efficiency, Journal of Economic Theory 59,297-308. Federal Reserve Bank of Chicago, Financial Markets Group.